US-China Trade Gets Rocky: What Business Must Do Now

Pic Copilot Team

Pic Copilot TeamOn May 12, 2025, the U.S. and China committed to take a series of actions to suspend or remove the recently imposed tariffs on each other's goods—but it came with a twist. Instead of easing tensions, the deal introduced tariffs on $65 billion worth of consumer goods.

This surprised the market. U.S. consumer stocks dipped sharply, with the S&P Consumer Discretionary Index falling 2.4% in one day. That was the worst day since January. Trade changes things for stores and shoppers.

Smart companies can deal with these changes. They can find new ways to get products and save money. They can also sell in more places. Read on for good ideas and what's happening now. Find out how you can maintain your lead.

The May 12 Agreement: A Deal That Bites Back

The U.S. and China made a deal to help with trade. It starts on May 14, 2025, for 90 days. Both sides will lower some taxes they added on each other's goods. But they will still have a 10% tax.

China will stop its extra taxes, too. This is good news for talks. Top leaders from both China and the U.S. will keep talking. They want a mutually beneficial economic relationship that helps both sides.

What This Means for the U.S. and China

Politically, both sides want to please their people. President Biden put some taxes back on Chinese goods. This was to help American jobs. It also stops China from controlling too many important things we buy.

At the same time, China agreed to stricter trade rules. This was to help keep their economy steady, especially since they sold a lot of things to other countries, and people around the world weren't buying as much as before.

Yet economists warn that these tactical moves could backfire.

"This agreement looks tough on paper, but it's a double-edged sword," said Mei Lin, Chief Economist at PacificTrade Analytics. "Tariffs on essential goods hurt middle-income consumers the most, especially during inflation recovery."

Trump-Era Tariffs Make a Comeback—and So Does Volatility

The reintroduction of Trump-era tariffs, albeit under a new label, stirred fears of a new trade war. Key affected industries include:

- Electronics: According to Goldman Sachs estimates, prices on imported gadgets could rise by 8–12%.

- Apparel: Retailers like Nike and Levi's saw 4% and 5.3% stock drops respectively.

- Furniture and Home Goods: Wayfair and RH also plunged, expecting higher import costs.

"Consumers will feel this by Q3," warned Janet Hines, Trade Policy Analyst at Brookings. "Retailers have no room left to absorb costs. Expect price hikes by back-to-school season."

What Businesses Should Do—Now

If you're a business owner, procurement lead, or part of a global supply team, don't wait. Here's what you must do right away:

1. Audit Your Supply Chain

- Identify China-dependent SKUs.

- Flag products hit by the 2025 tariff list.

- Review freight and customs routes.

2. Explore Alternative Markets

- Look to Vietnam, India, and Mexico for manufacturing options.

- Use smart sourcing tools like Accio.com to compare verified suppliers and production costs.

3. Negotiate Smarter Contracts

- Add tariff flexibility clauses to future purchase agreements.

- Working with partners to pay tariffs helps you not lose money.

4. Communicate with Customers

- When it comes to price changes, be forthright and honest.

- Provide early bird prices, packages, or loyalty programs to keep customers.

5. Leverage AI Forecasting Tools

- Use AI-powered tools to predict price shifts and consumer demand.

- Platforms like Kearney Predict and TradeFlow AI are becoming essential.

Heads Up: Charting the Course Through Coming Headwinds!

The next six months demand vigilance. Be aware of:

- Currency Quivers: A weaker yuan from uncertain trading could unexpectedly erode earnings.

- Sudden Rule Shifts: Either side's abrupt tightening of import/export rules can wrench your operations.

- Delivery Snags: Longer customs checks might lead to frustrating delays in getting goods where they need to be.

Smart Moves: Keep a close watch on currency markets and consider hedging. Stay informed on regulatory updates. Maintain flexible inventory and communicate proactively. For timely insights on how to navigate these currents, follow the Accio blogchannel!

What Comes Next?

All eyes are on the June trade compliance hearings in Washington and Beijing. Companies want to know which products won't get hit with these new taxes and how things will work at the border when goods come in.

Bosses must prepare for ups and downs but make quick, smart moves.

As Lin from PacificTrade Analytics puts it: "The winners in this new deal won't be the loudest. They'll be the fastest and most adaptable."

Final Thoughts: Time to Act

This is not the time to observe. Globally, things are improving, and commerce between the U.S. and China is rapidly evolving. Therefore, what you do next is crucial.

Verify the products you purchase from foreign nations. Look for several vendors to buy from. Inform your customers of the situation. Please do it before everyone else does, or you risk missing out!

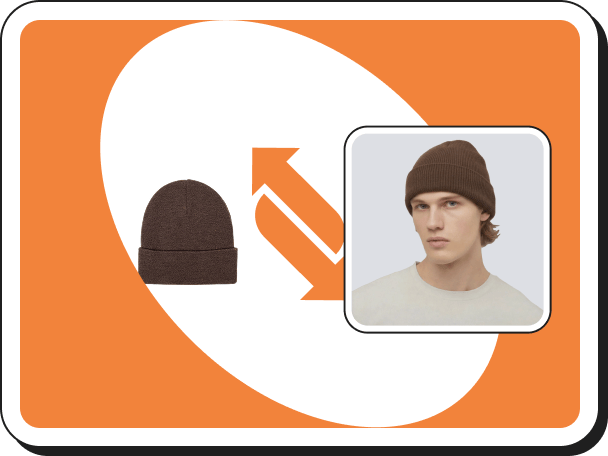

Виртуальная примерка

Виртуальная примерка Смена модели ИИ

Смена модели ИИ Видео с моделями

Видео с моделями Видео с Товарами в Руках

Видео с Товарами в Руках Товар в руке

Товар в руке Виртуальная примерка аксессуаров

Виртуальная примерка аксессуаров ИИ-фоны

ИИ-фоны Клон стиля

Клон стиля Удалить водяной знак

Удалить водяной знак ИИ-шаблоны

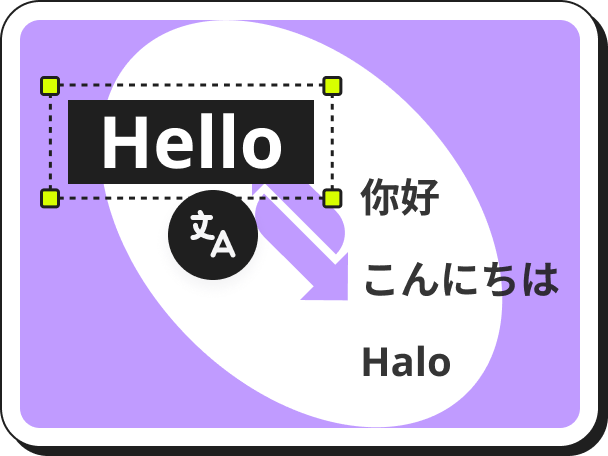

ИИ-шаблоны Перевод изображений

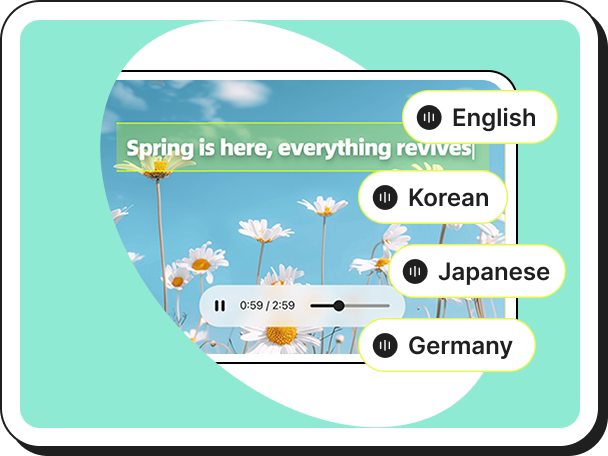

Перевод изображений ИИ-озвучка

ИИ-озвучка Виртуальная примерка обуви

Виртуальная примерка обуви ИИ-аватары

ИИ-аватары Удаление фона

Удаление фона ИИ-Тени

ИИ-Тени Масштабатор изображений

Масштабатор изображений Улучшитель изображений

Улучшитель изображений